Trick Tips to Attain Success Through Efficient Offshore Service Development

When embarking on offshore company formation, selecting the best jurisdiction is critical. Understanding these fundamental actions not only establishes the phase for successful worldwide development yet additionally highlights the elaborate dancing in between risk and incentive in worldwide service.

Selecting the Optimum Territory for Your Offshore Organization

When establishing an offshore organization, choosing the ideal territory is vital. A steady political climate makes certain that the organization procedures are not endangered by neighborhood turmoils.

Tax efficiency likewise plays a substantial function in territory option. Numerous offshore areas use tax rewards to draw in foreign financial investment, which can considerably reduce a firm's economic concerns. Nonetheless, the benefits of lower taxes need to be evaluated against the possibility for international scrutiny and conformity issues.

Last but not least, the high quality of lawful framework can influence organization operations. Jurisdictions with well-developed legal systems give far better protection for intellectual property, more clear agreement enforcement, and extra effective dispute resolution systems. Business owners should extensively research study and evaluate these aspects to ensure their overseas venture is built on a strong structure.

Navigating Governing and legal Frameworks

After selecting a proper territory, services need to faithfully browse the complicated legal and regulatory structures that govern their operations offshore. This job includes understanding and abiding by a wide range of laws that can differ dramatically from one nation to another. Secret areas typically include business administration, work legislations, privacy guidelines, and industry-specific compliance standards.

To efficiently take care of these demands, companies regularly engage neighborhood lawful professionals that can supply insights right into the nuances of the jurisdiction's lawful system. This experience is critical for setting up frameworks that are not only compliant however also optimized for the functional objectives of the organization. Additionally, continual monitoring of lawful changes is essential, as non-compliance can result in severe charges, including penalties and reputational damage. As a result, preserving an agile technique to governing conformity is vital for any service intending to maintain its offshore operations effectively - Offshore Business Formation.

Leveraging Tax Obligation Benefits in Offshore Jurisdictions

One of the most compelling factors for companies to establish procedures in overseas jurisdictions is the potential for substantial tax benefits. Offshore financial centers commonly use rewards such as no funding gains tax obligation, no inheritance tax, and reduced business tax rates.

In addition, the possibility of delaying taxes by holding profits within the offshore company permits services to reinvest their earnings right into expanding operations or research study and advancement, even more sustaining growth and development. Nonetheless, it is critical for firms to browse these benefits within the lawful frameworks and worldwide tax obligation compliance criteria to prevent consequences such as penalties and reputational damage. Making use of these see tax frameworks effectively can cause significant long-term financial advantages for companies.

Performing Thorough Due Diligence

Assessing political check these guys out security and economic conditions within the territory likewise creates a vital component of due diligence. Such analyses aid in forecasting possible difficulties and sustainability of the service atmosphere, making sure that the overseas venture continues to be viable and safe and secure over time.

Partnering With Reputable Regional Specialists and Advisors

To browse the complexities of offshore service development effectively, partnering with reputable local professionals and experts is vital. These experts have nuanced understanding of the local legal, financial, and cultural settings, which are critical for guaranteeing conformity and enhancing business operations in foreign areas. Local experts can give important understandings into market problems, regulative modifications, and potential dangers related to the offshore organization landscape.

Involving with local specialists additionally facilitates smoother combination right into the service area, fostering relationships that can cause lasting advantages and assistance. They work as essential intermediaries, aiding to bridge the gap between international organization techniques and neighborhood assumptions, thus lessening misconceptions and disputes.

Moreover, these consultants are crucial in browsing bureaucratic procedures, from registration to acquiring essential authorizations. Their competence guarantees that services comply with local legislations and guidelines, preventing expensive lawful concerns and possible reputational damages. Hence, their duty is essential in developing a effective and lasting offshore enterprise.

Final Thought

In verdict, success in offshore company formation more info here hinges on picking the ideal territory, understanding lawful and tax obligation structures, and carrying out considerable due diligence. Thus, a well-executed overseas technique not only minimizes threats yet likewise maximizes possibilities for long-lasting business success.

After selecting an appropriate jurisdiction, services should faithfully browse the intricate legal and governing frameworks that regulate their operations offshore.One of the most engaging reasons for businesses to establish operations in offshore territories is the potential for substantial tax obligation advantages.Moreover, the possibility of delaying taxes by holding profits within the offshore firm allows businesses to reinvest their earnings into broadening procedures or research and development, better fueling growth and innovation.While exploring the prospective tax obligation advantages of overseas territories, businesses should likewise focus on performing detailed due diligence.In conclusion, success in overseas company formation hinges on selecting the ideal jurisdiction, recognizing legal and tax frameworks, and performing considerable due diligence.

Alfonso Ribeiro Then & Now!

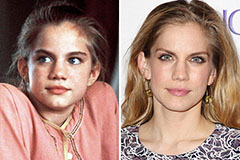

Alfonso Ribeiro Then & Now! Anna Chlumsky Then & Now!

Anna Chlumsky Then & Now! Josh Saviano Then & Now!

Josh Saviano Then & Now! Patrick Renna Then & Now!

Patrick Renna Then & Now! Yasmine Bleeth Then & Now!

Yasmine Bleeth Then & Now!